Car title loan data protection laws safeguard borrowers' sensitive information and build trust. Both parties must understand these regulations, with lenders implementing encryption, secure storage, and strict access controls for vehicle equity assessments and interest rates. Lenders in cities like Dallas have a responsibility to protect personal and financial info through robust systems, encryption, and regular security audits. Lenders are legally obligated to safeguard borrower data, employing secure platforms, encrypting records, auditing practices, flexible payments, and transparent terms.

Car title loan data protection is not just a best practice—it’s legally required. In an era where personal information is a valuable commodity, understanding and adhering to data protection laws is paramount for lenders. This article delves into the intricacies of car title loan data protection, exploring how these regulations safeguard borrowers’ sensitive information and mitigate the severe impacts of potential data breaches. By examining lender responsibilities, we uncover the crucial role of robust data security measures in maintaining trust and compliance.

- Understanding Car Title Loan Data Protection Laws

- The Impact of Data Breaches on Borrowers

- Safeguarding Personal Information: Lender Responsibilities

Understanding Car Title Loan Data Protection Laws

Car title loan data protection laws are crucial for safeguarding sensitive information related to borrowers’ vehicle details and financial transactions. These regulations ensure that lenders handle customer data responsibly, promoting transparency and fairness in the lending process. Compliance with such laws is not just a legal requirement but also fosters trust between lenders and borrowers.

Understanding these data protection laws is essential for both parties involved in car title loans. Borrowers should know their rights regarding their personal and vehicle information, while lenders must implement secure practices to protect this data. This includes measures like encryption, secure storage, and strict access controls to prevent unauthorized use or disclosure of sensitive details, such as vehicle equity assessments and interest rates, which are critical aspects of these financial solutions.

The Impact of Data Breaches on Borrowers

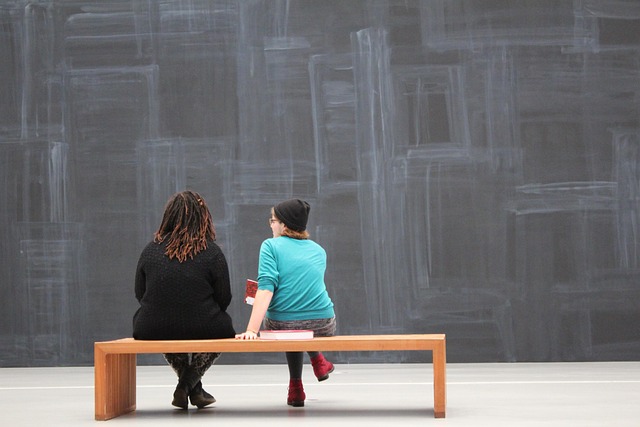

Data breaches in the car title loan industry can have severe consequences for borrowers. Personal and financial information, including names, addresses, income details, and vehicle valuations, is highly sensitive. When this data falls into the wrong hands, it can lead to identity theft, fraudulent transactions, and even financial ruin for the victims. Borrowers might find themselves targeted by scammers, facing unauthorized charges, or suffering from damaged credit scores, all of which can disrupt their daily lives and long-term financial stability.

These incidents not only pose individual risks but also erode trust in the lending sector. In a city like Dallas, where Dallas title loans are a common financing option, robust data protection measures are essential to safeguard consumers. Lenders must implement secure systems and protocols to prevent breaches, ensuring customer information remains confidential. This includes employing encryption technologies, access controls, and regular security audits to mitigate risks and protect borrowers from the detrimental effects of data leaks, ultimately promoting transparency and fairness in the loan process.

Safeguarding Personal Information: Lender Responsibilities

Lenders providing car title loans have a legal obligation to safeguard the personal information of their borrowers. This responsibility extends beyond simply securing the loan agreement; it encompasses the entire process of data collection, storage, and management. Lenders must implement robust security measures to protect sensitive data such as social security numbers, income details, and vehicle registration information. Failure to do so can lead to severe legal repercussions under data protection regulations.

In ensuring Car title loan data protection, lenders play a pivotal role in maintaining the privacy and financial security of their clients. This involves employing secure digital platforms for data exchange, encrypting sensitive records, and regularly auditing data handling practices. Additionally, lenders should offer borrowers flexible payments plans and transparent terms to further build trust, as quick approval processes do not compromise on data protection best practices.

Car title loan data protection is not just a best practice, but a legally required safety net designed to safeguard sensitive borrower information. By understanding and adhering to these regulations, lenders can mitigate the significant risks associated with data breaches, protect their customers’ privacy, and maintain public trust in the car title loan industry. Ensuring robust security measures for personal data is paramount to fostering transparency and ensuring borrowers remain secure in their financial transactions.